Financial services organisations face mounting pressure to modernise their IT infrastructure and keep pace with customer expectations. Migrating to the cloud has moved from an option to an imperative in this sector. In fact, Gartner forecasts that worldwide end-user spending on public cloud services will reach $723.4 billion in 2025, a 21.5% rise from 2024. Financial institutions cannot afford to lag as cloud becomes the backbone of digital transformation across industries. Yet today, less than 15% of financial services institutions globally qualify as innovators, according to some sources that are fully leveraging cloud for top-line growth. The vast majority have significant ground to cover, making now the time to move to the cloud.

Why FSIs Must Embrace Cloud Now

Staying competitive in banking, insurance, and wealth management means delivering services with greater agility, scalability, and cost-efficiency. Cloud platforms like Microsoft Azure offer on-demand resources and advanced services (AI, data analytics, etc.) that on-premises setups struggle to match. According to a study by McKinsey & Company (2022), banks that moved to the cloud saw 34% average infrastructure cost reduction and a 196% ROI over five years. More strikingly, only about 40% of cloud’s value came from IT cost savings – the rest was driven by increased revenue through improved customer experiences and faster product launches. Clearly, the cloud isn’t just a cheaper data centre; it’s an innovation engine enabling new services and better customer outcomes.

Beyond cost and speed, resilience and security are crucial drivers. Despite early hesitancy around cloud security, recent data shows cloud-forward banks suffer fewer incidents than those on legacy systems. IBM found hybrid-cloud financial institutions experienced 35% fewer security breaches compared to on-premises peers. Leading cloud providers such as Microsoft Azure invest billions in security capabilities (encryption, threat detection, rapid patching) that individual firms benefit from. In a sector where trust is paramount, the enhanced security and disaster recovery capabilities of cloud architectures bolster operational resilience.

Perhaps most importantly, the cloud accelerates digital innovation. It provides the flexibility to experiment with new fintech partnerships, deploy updates continuously, and scale services to meet demand. For example, cloud-mature banks integrate with nearly 5 times more external partner APIs than cloud laggards, allowing rapid introduction of new offerings. With emerging tech like generative AI on the horizon, having workloads in the cloud will be essential to harness these advancements. Gartner predicts 90% of organisations will adopt cloud by 2027, often to support AI and data-intensive applications. Financial firms must lay their cloud foundations now to remain future-proof.

Benefits of migrating to the cloud for Financial Services

Agility & Speed to Market: Cloud-native financial organisations can launch new digital products in weeks rather than months, responding faster to customer needs and the competition. This agility drives growth by capturing opportunities early.

Cost Efficiency at Scale: Usage-based cloud pricing means you pay only for what you use, avoiding large upfront capital outlays. Automatic scaling prevents over-provisioning. Many financial organsiations have trimmed ongoing IT costs significantly by moving workloads to Azure cloud or other public clouds.

Enhanced Customer Experiences: Cloud enables the real-time processing and analytics needed for personalised services (e.g. instant loan decisions, setup of services or fraud alerts). According to J.D. Power’s Banking Satisfaction Study (2022), cloud-leading banks scored 23 points higher in customer satisfaction versus those with minimal cloud adoption , thanks to faster apps and fewer outages.

Resilience & Compliance: Leading cloud platforms offer built-in high availability across regions and robust disaster recovery. This helps meet stringent uptime and data protection requirements. Multi-cloud strategies are also emerging as 79% of large banks distribute workloads to mitigate vendor risk and ensure compliance across jurisdictions.

Overcoming Challenges (Regulation & Legacy Systems)

While the benefits are clear, cloud migration in financial organisations come with challenges. Top concerns include regulatory compliance, data security, and integration with legacy systems.

Financial regulators globally enforce strict guidelines on data residency, privacy, and outsourcing risk. The key is to work closely with regulators and partners like ANS and leverage frameworks such as Microsoft’s Cloud Adoption Framework to ensure compliance. Many institutions adopt a hybrid cloud approach – keeping sensitive workloads on private clouds or on-premises, while moving others to public cloud – to satisfy regulations while still benefiting from cloud scalability.

Legacy core banking systems present another challenge. A typical large bank runs hundreds of legacy applications, and “Big bang” migration is risky and costly. Instead, successful institutions take a phased approach:

- Migrate peripheral systems first,

- Establish cloud data lakes alongside core systems for analytics,

- Gradually modernise or decompose legacy apps (the “strangler” pattern).

This progressive modernisation approach avoids disruption and delivers quick wins that build momentum for broader transformation. With proper planning and executive backing, even mainframe-dependent institutions have begun their cloud journeys.

ANS’s Cloud Migration Navigator and Multi-Diciplinary CoE

At ANS, we recognise that moving to the cloud is a journey. That’s why we’ve developed two key services to support financial organisations:

Cloud Migration Navigator: Our Cloud Migration Navigator is an in-depth assessment engagement that provides

- A tailored case for change.

- Total Cost of Ownership analysis.

- A detailed migration roadmap.

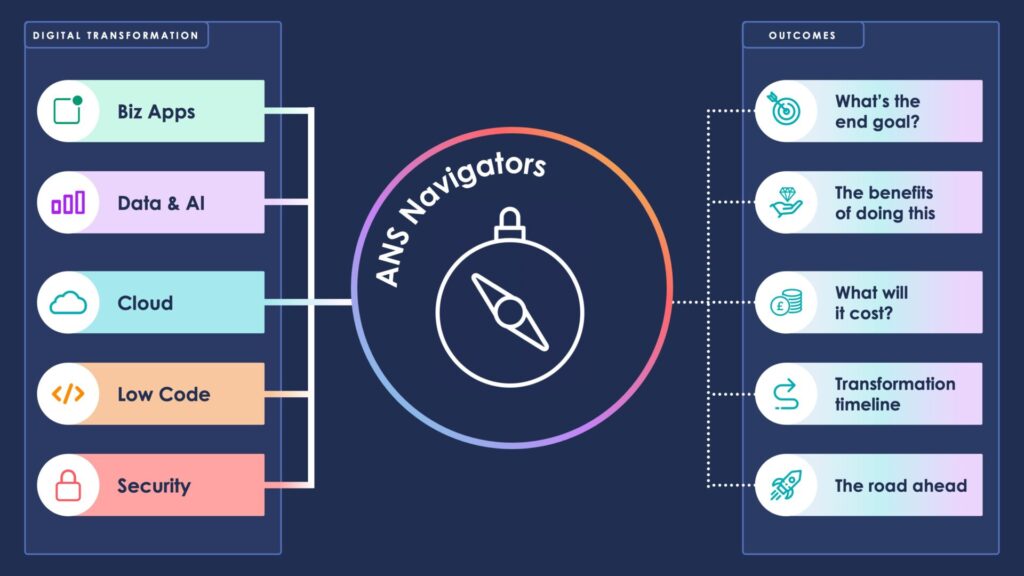

In a matter of weeks, ANS Cloud Migration Navigator engagement provides the strategic clarity (and board-ready justification) CIOs and Transformation Directors need to move to the cloud confidently. We align to Microsoft’s best practices and even help unlock funding programs to minimise upfront costs. The below shows how Navigators can support your digital transformation goals and how they can help take an initial concept of a project to a realised objective.

ANS’s Cloud Centre of Excellence (CoE)

After the initial migration project, how do you continuously optimise and innovate in the cloud?

This is where ANS’s Cloud Centre of Excellence (CoE) managed service comes in. The Cloud CoE gives clients on-demand access to a squad of Azure experts to continually develop and optimise your cloud environment. Rather than hiring a large in-house cloud ops team, you can tap our pool of certified engineers as needed – avoiding idle costs while ensuring expert help is always available. We work in sprint cycles on your backlog of improvements (automation, performance tuning, security enhancements, etc.), going beyond standard managed services. This flexible model means your cloud platform keeps evolving to deliver maximum value, long after the initial cloud migration.

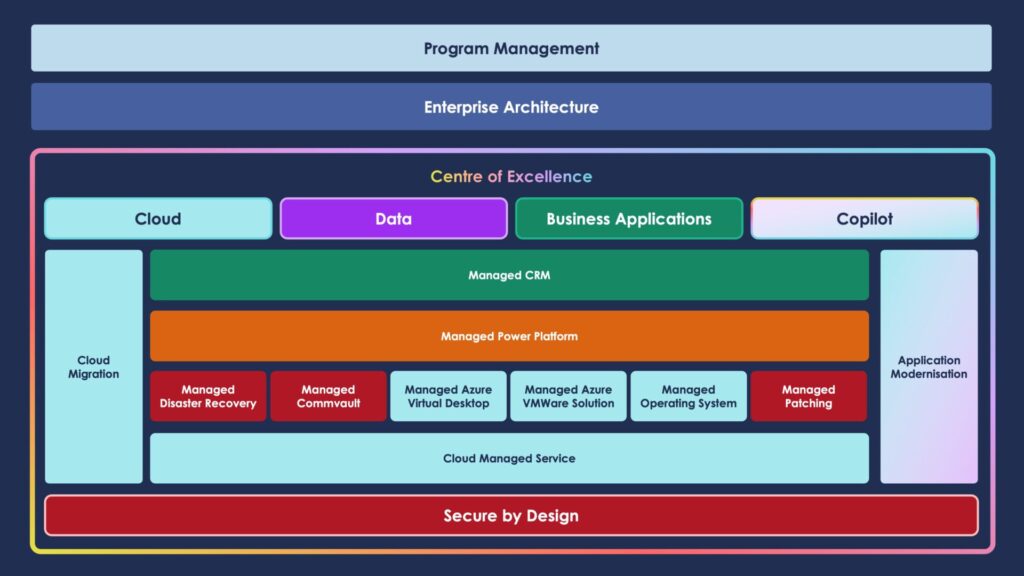

The below shows how the ANS CoE can bring together the foundations of a cloud managed service with other service elements like managed backup, managed azure site recovery and others to be supported with the CoE, Program Management and Enterprise Architecture to support not just business as usual activities but also digital transformation at scale.

Conclusion: Seizing the Cloud Opportunity

Financial services leaders who hesitate or delay on cloud migration risk falling behind more nimble competitors and even fintech entrants. Moving to the Cloud is not a future trend; it’s a present mandate for those aiming to

- Deliver superior customer experiences

- Drive down costs

- Innovate at speed

Realising Long-Term Value from Cloud Adoption

Future-Proof Your Institution

Don’t get left in the IT past. Join our upcoming webinar “Accelerating Cloud Migration in Financial Services” – co-hosted by ANS and Microsoft to learn how to jumpstart your cloud journey. You’ll hear

- Real-world success stories

- Gain practical guidance on navigating compliance,

- Build your cloud business case,

- How to leverage Azure to transform your organisation.

Register here to future-proof your financial institution in the cloud era.

How ANS can help?

By combining a clear migration roadmap (Navigate) with ongoing improvement (Evolve), ANS helps financial institutions realise immediate and lasting benefits from Azure cloud adoption. We’ve guided UK banks, insurers, and building societies through complex cloud migrations – from exiting traditional data centres to re-platforming core applications – all while adhering to industry compliance and security benchmarks.

Get in touch with ANS’s cloud experts today to start your journey.